The emergence of the metaverse represents one of the most profound shifts in digital interaction since the advent of the commercial internet.

This fully realized, persistent, and shared virtual reality is rapidly transitioning from a science-fiction concept to an active economic landscape.

Within this burgeoning digital realm, activities mirroring real-world commerce, social interaction, and entertainment are proliferating at an astonishing pace.

Unsurprisingly, one of the most commercially compelling and legally challenging developments is the rise of the metaverse casino, an immersive three-dimensional gambling experience often powered by cryptocurrencies and non-fungible tokens (NFTs).

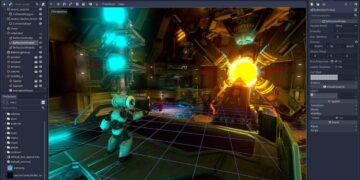

These virtual casinos offer an unparalleled level of immersion, allowing players to walk a virtual casino floor as avatars, interact with dealers, and place wagers with digital assets.

However, this blend of highly regulated activity—gambling—with an unregulated, borderless, and decentralized technology—Web3—creates a Gordian knot of legal issues.

Governments and regulatory bodies worldwide are now scrambling to determine how to apply centuries-old legal principles to this entirely new digital frontier, confronting everything from licensing and anti-money laundering compliance to taxation and consumer protection for a global, anonymous user base.

The future of the metaverse casino hinges entirely on the difficult, often conflicting, decisions regulators will make in the coming years.

The Jurisdictional Maze: Where Exactly is the Virtual Casino Located?

The most fundamental legal challenge facing metaverse casinos is the concept of jurisdiction. Traditional gambling laws are inherently geographic, relying on the physical location of the operator, the player, or the server. The metaverse obliterates these geographical boundaries.

A. The Operator’s Location is Obscured

The operators of metaverse casinos often leverage Decentralized Autonomous Organizations (DAOs) and smart contracts.

These structures can make it virtually impossible to pinpoint a central legal entity or physical office.

Determining which country’s laws apply to a casino built on a blockchain and governed by a DAO is a massive undertaking for global regulators.

B. The Player’s Location is Irrelevant

A player in a jurisdiction where online gambling is illegal can simply mask their location using a VPN or access the casino via a decentralized platform, frustrating geo-blocking measures.

This effectively allows users to bypass local laws intended to protect citizens or uphold state monopolies on gambling.

The concept of “Know Your Customer” (KYC) compliance, a cornerstone of financial regulation, is severely undermined by this borderless nature.

C. The Server’s Location is Distributed

The core functionality of a blockchain-based metaverse casino is distributed across thousands of computers globally, rather than residing on a single physical server in a licensed territory.

This distribution of data and execution logic removes the primary anchor point for legal enforcement that regulators have relied on for decades with traditional online casinos.

This inherent decentralization is a feature, not a bug, for the Web3 pioneers, but it is a monumental headache for government agencies.

D. Conflict of Laws in Action

If a player from Country X loses a significant amount of crypto in a casino operated from the metaverse land of an entity in Country Y, and the blockchain infrastructure is hosted globally, which country’s consumer protection, contract, and gambling laws should apply?

Legal scholars are currently debating whether the law of the operator, the law of the user, or even a specialized set of “meta-laws” will eventually govern these transactions. The uncertainty created by these conflicts significantly elevates the risk for both players and operators.

Financial Regulation: AML, KYC, and the Crypto Layer

The vast majority of metaverse casinos operate exclusively using cryptocurrencies like Ethereum, SAND, or the platform’s native tokens. This choice of currency intertwines gambling regulation with the complex world of financial technology.

A. Anti-Money Laundering (AML) Compliance

Regulators worldwide are deeply concerned that metaverse casinos will become the next major vector for money laundering.

Large, anonymous deposits and withdrawals of cryptocurrency, often facilitated through mixing services or privacy coins, allow criminals to “wash” illicit funds.

Global bodies like the Financial Action Task Force (FATF) have issued guidance demanding that virtual asset service providers (VASPs)—a category that could include the developers or facilitators of metaverse casinos—implement stringent AML controls.

B. The Challenge of “Know Your Customer” (KYC)

Traditional, licensed online casinos are legally required to verify the identity of their players to prevent fraud, underage gambling, and money laundering.

In the decentralized metaverse, where users value anonymity and connect only through a crypto wallet address, imposing traditional KYC requirements is philosophically and technically difficult.

While some centralized platforms (Web2.5) are attempting to integrate identity checks, purely decentralized gambling protocols struggle to comply, risking massive regulatory penalties.

C. The Volatility of In-Game Assets

Many metaverse casinos allow players to wager NFTs or platform-specific tokens whose value is highly volatile.

This financial risk goes beyond typical gambling loss; it introduces a new layer of consumer protection concern.

Regulators must determine if these speculative assets qualify as “money’s worth” for gambling purposes and how to safeguard players against sudden market crashes that could instantly multiply their losses.

D. Licensing and Oversight Models

Regulators are exploring various models to manage this new form of crypto-gambling.

Some smaller jurisdictions, like Malta and Curacao, are attempting to create specific Blockchain Sandbox Frameworks to attract and regulate these companies in controlled environments.

Larger economies, however, are hesitant, often treating crypto-gambling platforms the same as unlicensed fiat casinos, leading to outright bans or aggressive enforcement actions.

The future likely involves a tiered licensing model that specifically addresses the decentralized nature of the technology.

Consumer Protection and Social Responsibility

Legal frameworks for gambling are not only about managing money; they are crucially about social responsibility and consumer protection, particularly regarding problem gambling and minors.

The immersive nature of the metaverse amplifies these concerns.

A. The Amplified Risk of Addiction

Virtual Reality (VR) and the immersive 3D nature of metaverse casinos make the experience more realistic and potentially more addictive than traditional flat-screen online gambling.

The line between entertainment and real-money wagering is further blurred when the environment mimics a physical casino perfectly.

This psychological factor necessitates new responsible gambling tools and clearer warning mechanisms.

B. Protecting Underage Users

Age verification is notoriously difficult in anonymous virtual environments. A child can easily create an avatar and a crypto wallet to access a metaverse casino, circumventing all standard age-gating procedures.

Governments are increasingly pressuring metaverse platforms to implement technology-based solutions, such as zero-knowledge proofs or biometric checks, to definitively block access to minors, a failure that could result in devastating legal consequences.

C. Dispute Resolution and Fairness

If a player believes a virtual game was rigged or a smart contract failed, who is the arbiter? Decentralized platforms often rely on the immutability of the blockchain, but this offers little recourse for a user in a legal sense.

Regulators will need to mandate clear, legally binding dispute resolution mechanisms, whether through third-party auditing of smart contracts or via mandatory arbitration with a licensed entity.

The principle of “provably fair” gaming, while common in crypto casinos, must be legally enforceable.

D. The Status of In-Game Loot Boxes

The legal classification of loot boxes—virtual items purchased with real money, offering random rewards—already sits in a grey area, with many countries classifying them as a form of illegal gambling.

In the metaverse, where these items can be NFTs traded for significant real-world value, this legal ambiguity intensifies.

The boundary between a collectible item and a gambling instrument is constantly being tested by metaverse developers, and courts are beginning to step in with decisive rulings.

Taxation: Winnings, Losses, and Virtual Value

The borderless and crypto-based nature of metaverse casino winnings and losses introduces unprecedented complexity for tax authorities globally.

The key question is when income is “realized” and how its value is accurately measured for tax purposes.

A. Taxation of Winnings and Income

Is a winning wager paid out in MANA (a metaverse coin) considered taxable income at the moment of receipt, or only when the player converts that MANA to fiat currency?

Tax authorities, like the IRS, typically treat cryptocurrency as property (a capital asset), not currency. This means that every time a player uses crypto to place a bet, it could theoretically be a taxable event (a disposal of property).

However, the complexity of tracking thousands of micro-transactions makes this approach impractical.

Most tax scholars argue that winnings should be taxed upon the conversion to a fiat currency or when the crypto is used to acquire another asset of value (like an NFT or virtual land), but clear official guidance is still lacking.

B. Deductibility of Losses

In many jurisdictions, gambling losses can be deducted against winnings to reduce the overall tax burden.

Applying this principle to volatile cryptocurrency and NFT losses is exceptionally difficult.

If a player loses an NFT whose value drops by 50% between the time of acquisition and the wager, how is the actual loss for tax purposes calculated?

New valuation and reporting standards are desperately needed to address the financial reality of this volatile asset class.

C. The Role of the DAO in Reporting

Traditional casinos are legally obligated to issue tax forms (like the W-2G in the U.S.) to winners and report large winnings to tax authorities.

A decentralized, pseudonymous DAO has no such legal identity or mechanism for compliance.

This lack of reporting infrastructure is the single largest threat to government tax collection from the metaverse, forcing authorities to rely heavily on individual player self-reporting, wallet tracing, and data sharing agreements with centralized crypto exchanges.

D. International Double Taxation

With multiple potential jurisdictions claiming authority over a single virtual transaction, the risk of double taxation—where two different countries claim tax rights over the same winning—is high.

The lack of specific international tax treaties for virtual assets and metaverse income creates a significant barrier for global players and legitimate operators seeking to establish stable business models.

The Path Forward: Legislative Action and International Cooperation

The current patchwork of old laws and new technology is unsustainable for the metaverse casino industry. Legal clarity is necessary for the industry to move past its current state of regulatory uncertainty and achieve its full potential.

A. Unified Definition of Gambling

Regulators must first agree on a universal, technology-agnostic definition of what constitutes “gambling” in the context of virtual assets, distinguishing it clearly from collectible NFTs or investment instruments.

B. Mandatory Wallet Identification

A key step will be the global imposition of mandatory KYC/AML procedures tied to the crypto wallets used for large metaverse gambling transactions, likely through specialized VASP licenses.

C. Cross-Border Enforcement Treaties

New international treaties are essential to determine which country’s gambling license is valid and enforceable across the global, borderless metaverse.

D. Tech-Specific Regulatory Sandboxes

Governments should establish dedicated “regulatory sandboxes” that allow metaverse casino technology to be tested under light regulation before full, permanent laws are implemented.

E. Smart Contract Auditing

Mandatory, independent auditing of the smart contracts that govern the odds and payouts of metaverse games is crucial to ensure verifiable fairness and transparency for all players.

F. Public-Private Partnerships

The best way forward involves close collaboration between regulators, blockchain developers, and gambling operators to craft rules that protect consumers without stifling the innovative core of the technology.

Conclusion

The metaverse casino presents a spectacular confluence of financial opportunity and regulatory peril. This is an exciting new frontier for digital entertainment.

The immersive nature of virtual reality casinos is already attracting millions of global users. However, the blending of decentralized crypto and gambling has created a legal void.

This void is characterized by profound jurisdictional ambiguity that must be addressed. Legislators worldwide are navigating this complex terrain with understandable caution and intense scrutiny.

The decisions made today will ultimately shape the legal and financial structure of the entire metaverse.

The industry’s future success is entirely dependent on its ability to embrace stringent regulatory compliance.

This compliance must balance the core decentralized values of Web3 with the imperative of consumer protection and responsible financial oversight.

The age of the unregulated virtual wild west is drawing to a close. A new era of responsible, if complex, virtual gambling is set to begin.